Investment Areas

The City of Bend has three established Investment Areas – Core Area, Juniper Ridge, and Murphy Crossing.

The Bend Urban Renewal Agency (BURA) manages some special areas for investment. Urban Renewal is a program that helps fix up parts of cities that are run-down, not growing, unsafe, or just not working well anymore. It uses something called Tax Increment Financing (TIF) to pay for these improvements.

Urban renewal through Tax Increment Financing helps make the changes needed for the city to grow and improve.

Investment Areas

To view boundaries of the City’s three TIF/Urban Renewal areas and whether a particular property is located within a TIF/Urban Renewal area, please refer to this map. To view the boundaries alongside other City data, visit our Community Development Data Explorer (click the Layer List, and check Urban Renewal District).

Core Area

The Core Area Tax Increment Finance (TIF) Plan, adopted in 2020, includes four of the nine citywide “opportunities areas” that were identified in the 2016 Comprehensive Plan update. These opportunity areas are locations within the City where growth is encouraged, and include the Bend Central District, KorPine, East Downtown, and Inner Highway 20/Greenwood. The Plan has a duration of 30 years and a maximum amount of indebtedness – amount of tax increment financing for projects and programs that may be issued for the Plan, of $195,000,000.

Juniper Ridge

The Juniper Ridge Urban Renewal Plan, adopted in 2005, and amended in 2019, has a duration of thirty years. The overall purpose of the Plan is to use the tools provided by TIF/Urban Renewal to overcome obstacles to new development and ensure the highest and best use of the properties within the Area. The maximum amount of indebtedness – amount of tax increment financing for projects and programs – that may be issued for the Plan is $41,250,000.

Murphy Crossing

The Murphy Crossing Urban Renewal Plan, adopted in 2008, is the culmination of years of study of the Murphy Crossing Refinement Area, where access and circulation have been negatively affected by the location and configuration of the US 97 Parkway. The overall purpose of the Plan is to use tax increment financing to overcome obstacles to proper development of the Area by assisting with the funding of access and utility improvements, including the overcrossing of the Bend Parkway at Murphy Road and a system of local streets. The maximum amount of indebtedness – amount of tax increment financing for projects and programs – that may be issued for the Plan is $52,600,000.

Frequently Asked Questions

As part of the City’s commitment to equity and inclusion, the Bend Urban Renewal Agency (BURA) will make all possible attempts to use the term Tax Increment Finance or TIF rather than “urban renewal”. The term TIF is used consistently in other parts of the country and does not evoke past practices of other urban renewal agencies throughout the country wherein minorities and vulnerable populations were displaced to clear the way for redevelopment. This department, and its communication, aims to avoid those connotations and outcomes. Utilizing the term TIF does not affect the statutory authority of ORS 457.

TIF (tax increment financing is a program used throughout Oregon to provide a financing mechanism to implement city plans in designated TIF/urban renewal areas. The goal of TIF is to make investments that spur private development that would not otherwise have occurred. The revenue to pay for projects in a TIF area is generated by the growth in assessed property value. TIF funds may be invested in administration of the plan and in capital projects, such as streetscape improvements, new construction or rehabilitation, or other physical investments in the public or private realm. Those projects must be described in an adopted TIF plan that meets statutory requirements defined in ORS 457.

Yes. Currently there are 2 (two) established TIF areas within the City of Bend limits: Murphy Crossing and Juniper Ridge (both referred to as “urban renewal areas”). In 2018, the City Council, acting as the Bend Urban Renewal Agency (BURA), authorized staff to begin the feasibility and drafting of a third TIF area in and around the central area of Bend (see Core Area TIF page for more information).

BURA oversees the TIF program(s). BURA is made up of the members of the Bend City Council. The Economic Development Department administers the TIF program(s) on behalf of the City Manager and BURA/Council.

In Oregon, property taxes, with or without TIF, increase for two reasons: 1) The assessor may increase property assessed values by no more than 3.0% per year; 2) The property owner completes new construction or substantial renovation of their property resulting in increased assessed valuation.

When a TIF area is created, the property tax revenue from that area is diverted into the following revenue streams:

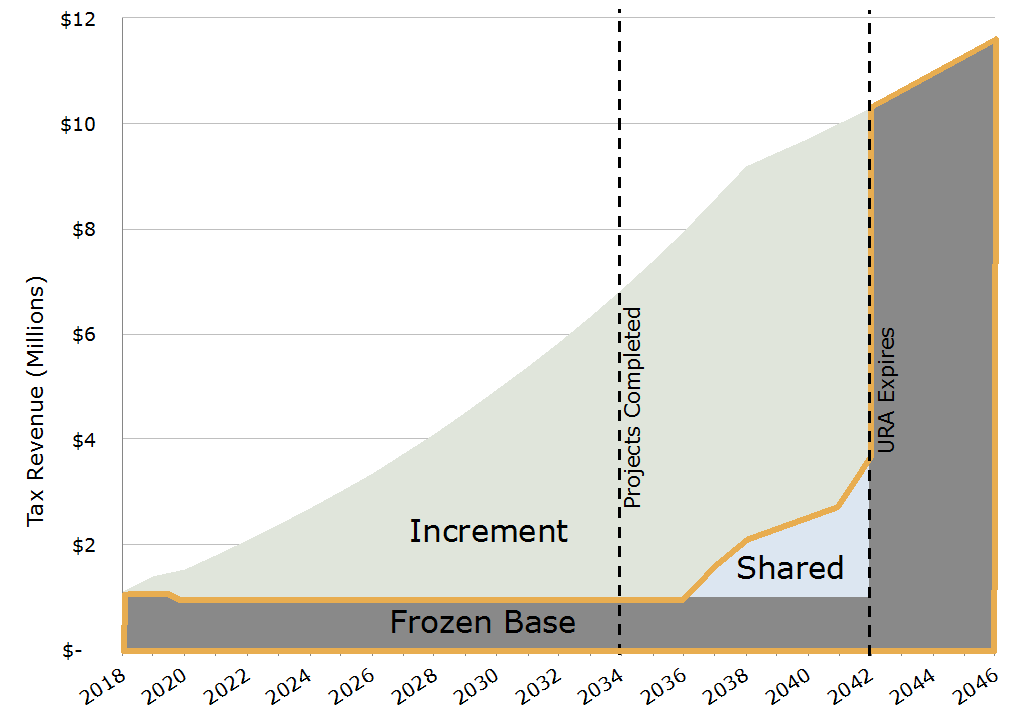

Frozen Base (shown in dark gray in the graphic below): The total assessed value of all properties in the TIF area when it is formed. The frozen base revenue stream continues to go to the regular taxing jurisdictions, such as the city, the county and the school district.

Increment (shown in light green below): These are the funds that are available to finance defined TIF projects in the plan. When property values increase over time from new development and appreciation, taxes off this growth goes to BURA for use in the TIF area for use on projects, programs, and administration defined throughout the life of the area, instead of going to the overlapping taxing districts.

Shared (shown in blue below): Once a TIF area is successful and generating significant increment each year, according to standards established in ORS 457, a portion of the increment is “shared” with affected taxing districts. Revenue sharing begins when tax increment revenues reach 10% of the initial maximum indebtedness (or the cap on total spending that is defined in the adopted TIF plan) in a given year a portion of the annual increment over 10% is shared with the overlapping taxing districts. Once tax increment revenues reach 12.5% of the maximum indebtedness, the increment to BURA is capped at 12.5% of the initial maximum indebtedness and the remainder of tax increment revenues are distributed to the overlapping taxing districts.

|

Early Years: Increment revenues are usually small. The urban renewal area incurs loans to fund strategic improvements to stimulate new development. |

Middle Years: Development occurs, boosting increment revenue. The urban renewal has more capacity to fund projects.

|

Late Years: Annual increment revenues are large. Final projects are completed, outstanding debt is repaid, and the urban renewal closes down. Revenue sharing may occur if thresholds are met. |

After Expiration: Once all projects have been completed and debt repaid, all of the tax revenue returns to overlapping taxing districts and they receive the benefits of increased property values. |

No. TIF is not a new tax on property and does not increase the amount a property owner pays in property taxes. Property taxes are based on the tax rate and the property’s assessed value and increases as the assessed value grows. TIF does not increase the tax rate.

The financial impact of TIF is not on the property tax payer, but on taxing jurisdictions. TIF revenues are generated from increases in assessed value of property within a TIF area after it is formed. While the TIF area is active, other taxing jurisdictions’ revenue from that area remains largely fixed, and the tax revenue from the increase in assessed values goes to BURA to pay for projects that help to spur new investment. When the TIF area expires, taxing jurisdictions can expect to receive more tax revenue than they would have without a TIF area, due to the increased assessed values stemming from the increased investment in the area.

A TIF area is created through a process that includes community input, notice to impacted taxing jurisdictions, and review by BURA, the Planning Commission, Deschutes County Commission, and the Bend City Council. The City Council hearing notice must be sent to each individual household in the City. Adoption of a plan must be by non-emergency ordinance by the City Council. The plan, together with an accompanying TIF report, identifies the goals of the TIF area and projects to be funded with TIF revenue, describes how the area complies with statutory requirements for blight, projects tax increment revenues, and identifies a maximum amount of debt a TIF area can incur, among other topics.

Each TIF plan contains a section on how amendments are processed. Minor amendments may be approved by the BURA itself. Substantial amendments are those that increase the maximum indebtedness or add property that totals over 1% of the existing acreage.

School districts are not directly affected by TIF. Under Oregon’s school funding law, the Oregon Department of Education combines property tax revenues with State School Fund revenues to achieve per-student funding targets. Under this system, property taxes foregone due to the use of tax increment financing are replaced with State School Fund revenues, as determined by the state funding formula. While TIF statewide has an impact on the amount of funding in the State School Fund, the legislature can re-allocate other funding sources to the State School Fund.

Over the long term, the TIF area could produce significant revenues for capital projects and spur private investment/development. Some examples of TIF investments include:

- Capital improvement loans for small or startup businesses

- Storefront improvement grants for improvements to existing properties

- Streetscape improvements and transportation enhancements, including new lighting, trees, sidewalks, and intersection improvements

- Redevelopment projects, such as mixed-use or infill housing developments

- Historic preservation projects

- Parks and plazas

- Utility or infrastructure projects to support new development

For more information on how the City uses Taxes and Fees for core services, please visit the City of Bend Finance Department webpage.