Short Term Rental Permits and Licenses

A short term rental is a house, apartment or room that is rented out for less than 30 consecutive days per guest.

The City of Bend limits and regulates short term rentals to balance neighborhood livability with private property rights and our tourism economy.

Transportation Fee Rates

On May 7, 2025, City Council adopted Phase 2 Transportation Fee rates, with a July 1, 2025, effective date.

Included in the rate schedule are Short-Term Rental Supplements that will be assessed on all new licenses and renewals.

The adopted rate schedule, including the details on these fees, can be found below:

Note that any Short-Term Rental authorized to rent out the entire house, including those units exempt from a land use permit in Mount Bachelor Village, Broken Top, and Deschutes Landing, is charged the “whole house” supplemental fee.

Renew Your Operating License

Fees:

Annual Renewal: $255 + Transportation Fee Supplement*

*Transportation Fee Supplement:

Authorized for whole-house rental use: $200/year

All others: $108/year

Note: supplemental fee takes into account the residential rate charged to the location’s utility bill.

Processing Time:

3-4 weeks from the time the application is completed. Note: make sure your Room Tax reporting is current and up-to-date to avoid extending the processing time.

When to Renew:

Annual operating license renewals are required, and notifications are sent automatically from the Online Permit Center Portal 60 days prior to your operating license expiration date. The notices are sent via email or mail, depending upon the communication preference you specified when you set up your account.

You have up to 30 days after your license expires to submit your renewal application, but you will have to pay a $55 late fee. If you don’t renew your operating license before the 30 days, it will expire and your land use permit will be voided.

Before You Begin Your Operating License Renewal

Complete the following items. These will be submitted with your application. Note: there is no “Save for Later” feature when working on your application, so it’s important that you have everything ready ahead of time.

- Proof of Notice to Neighbors

- If you provided a letter to neighboring property owners, submit a photo of the prepared envelopes and a copy of the letter with your application.

- If you posted a sign on the property, submit a photo of the posted sign with your application.

- Declaration of Notice to Neighbors

- Fire Safety Self-inspection Checklist & Reply Card

- Short Term Rental Acknowledgement

- Proof of Use

- Short term rental properties must be used at least one night within the 12 month licensed period in order to renew your Operating License. Submit room taxes as proof of use monthly or quarterly.

- Whole-house Unlimited and Owner-Occupied Room Rentals: You need to have a registered room tax account and submit your room tax reports monthly or quarterly through our Online Permit Center Portal.

- Whole-house Infrequent Use Rentals: You don’t need to pay room taxes because your permit limits short term rentals to no more than 30 days a year and no more than 4 rental periods—for example, two weeks in summer and two weeks in winter. You must upload proof that your property was used as a short term rental in the past 12 months, such as rental receipts, bookings, or contracts.

- If you have a Type-I STR Permit for both Infrequent Use and Owner-occupied Room Rentals: You must pay room taxes for the room rentals and upload proof of use for the infrequent whole-house rentals.

- Long-term Rental Exemption: You do not need to prove the property is used as a short term rental to renew your license if the property is currently being rented under a long-term residential lease (for 12 months or more). In this case, you must submit proof of the lease, following the Oregon Residential Landlord and Tenant Act. You can use this exemption for up to three license renewals. After that, you’ll need to go back to proving the property’s use for each annual renewal. Room tax reporting is not required for long-term rental activity, but any short term rental activity must still be submitted.

Instructions for submitting an operating license renewal application [PDF].

We will notify you if there is anything missing in your renewal application. You will then have 30 days to complete it. If the application is not completed in that time, your application will be withdrawn, fee refunded, and the Land Use Permit will become void.

Questions about operating licenses?

Please contact the Licensing Division at licensing@bendoregon.gov or 541-388-5580 ext. 8.

See Bend Code Chapter 7.16 for detailed information regarding short term rental operating licenses.

Submit Room Tax

All short term rentals—except those with an infrequent use permit—must pay a room tax of 10.4% of the gross revenue received for short term rental activity.

Depending on the amount of revenue you receive from your short term rental property, you will need to submit room tax reports and the taxes themselves on a monthly or quarterly basis.

Approved Short Term Rentals

Learn more about where existing short term rentals are permitted with this tool:

Report an Issue

Tenants and owners of short term rentals are encouraged to follow our Good Neighbor Guidelines, outlining the importance of being a good neighbor while visiting Bend. If you believe they are not, or you have other issues to report, visit the reporting page here:

Frequently Asked Questions

There are several different types of short term rentals, each with their own set of rules and regulations. This guide outlines each type: Type Designations Guide PDF.

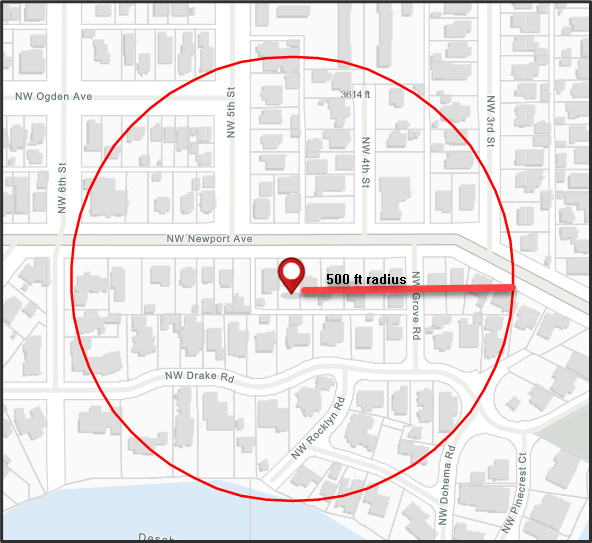

For Type II applications: There must be at least 500 feet of separation between properties permitted as whole-house short-term rentals. This 500-foot separation is measured radially from your property boundary and includes all properties wholly or partially within that radius. If any property within 500 feet of your property is an approved whole-house short-term rental, your property cannot be approved as a new whole-house short-term rental.

A separate permit is required for each, even if they are on the same legal lot.

For Type II short term rentals—whole-house properties that will be rented more than 30 days per year or more than four (4) rental periods within Residential and Mixed-Use Riverfront zoning districts (outside of the Old Mill District boundaries), only one unit on a property with multiple dwellings (i.e. ADUs, duplexes, triplexes, quadplexes, multi-unit, cottages, etc.) can be permitted as a short term rental. Refer to Bend Development Code 3.6.500 A.2.

The Short Term Rental Permit (for applications filed after April 15, 2015) is issued to you as the owner and does not transfer with the property. When you sell or transfer your property, the land use approval will be voided.

Note: once a property with multiple Short term Rentals is sold, any future Short term Rental request is limited to one unit, per Bend Development Code 3.6.500 A.2. If the buyer wants to use the property as a short term rental, they must apply for a new Short term Rental land use permit and, if approved, a new Operating License. See Bend Development Code 3.6.500.F for more details.

For approved Vacation Home Rental permit applications submitted on or before April 15, 2015, the land use approval runs with the land (i.e. the home still has land use approval to be used as a vacation rental). Legal non-conforming uses documented by the City with a letter may also continue after a sale or transfer to a new owner. The operating license, however, is issued to the property owner and is not transferable. If the property is sold, the new owner has 60 days from the closing date to file for a new operating license.

If you are unsure whether you hold a Vacation Home Rental Permit or a Short Term Rental Permit, please contact the Planning Division at 541-388-5580 ext. 3 or bendplanning@bendoregon.gov.

In order to maintain your Short Term Rental Land Use permit, two conditions must be met:

- You must use the property as a short term rental every 12 months. This is verified annually by providing proof of use documentation with your operating license renewal. You may also use the long-term rental exemption.

- You must obtain and maintain an annual Short Term Rental Operating License.

If you sell your property, the land use approval will terminate and become void.

If you use your property as a short-term rental for 30 days or more in a 12-month period, you must submit Room Tax, which serves as the primary proof of use. If you rent your property for fewer than 30 days in a 12-month period, you will need to provide alternative documentation of proof of use, such as a rental receipt or a rental contract.

Proof of Use Long-Term Rental Exemption: If you provide proof of a long-term residential lease of 12 months or more, drafted in compliance with the Oregon Residential Landlord and Tenant Act, they will not need to prove use of the property as a short-term rental for their license renewal. This exemption can be used for up to three license renewal applications. After that, licensees must revert to the proof of use requirement for annual renewal of the operating license.

All short term rentals—except those with an infrequent use permit—must pay a room tax of 10.4% of the gross revenue received for short term rental activity.

Depending on the amount of revenue you receive from your short term rental property, you will need to submit room tax reports and the taxes themselves on a monthly or quarterly basis.

Yes, all land use permits are required to have an active short-term rental operating license. This includes whole house rentals, owner-occupied room rentals, and whole house infrequent rentals.

If you want to operate a short term rental, here are the fees you need to pay:

- Land Use Permit Fee:

- Type I: $1,314.53 per application + 4% Long Range Planning Surcharge*

- Type II: $3,657.44 per application + 4% Long Range Planning Surcharge*

- Initial Operating License Fee: $350

- Operating License Renewal Fee: $255 annually

- Annual Transportation Fee: $200 for a regular “whole house” short term rental and $108 for all others

- Room Tax: 10.4% of gross sales

*The 4% surcharge is used to fund the City’s Long Range Planning program.

Late Application Fee: $55 (if you submit your application after the 60-day window)

Refund/Withdraw of Short term Rental Application: Up to 75% of the application fee is refundable, depending on when the application is withdrawn during the application process.

Appeal of Short term Rental Operating License Decision: $200.00 per appeal

If you have a Vacation Home Rental permit from before April 15, 2015, you can keep using it if you:

- Rent out the property at least once every 12 months.

- Maintain an annual operating license. If you sell the property, the new owner has 60 days from the date of closing to file for a new license.

- Don’t expand the rental space bigger than it was on April 15, 2015.

Yes, if your permit was approved before April 15, 2015, it runs with the land (i.e. stays with the property). The new owner must get a new operating license within 60 days of buying the property.

For permits approved after April 15, 2015, the permit is tied to the owner and becomes void if the property is sold.

If you are not certain whether you hold a Vacation Home Rental Permit or a Short Term Rental Permit, please contact the Planning Division at 541-388-5580 ext. 3 or planning@bendoregon.gov.

All short term rental operators must collect and remit Room Tax as proof of use.

If you have a Type-I Infrequent Use Permit, you must provide alternative documentation, such as a rental receipt or contract.

If you have a long-term lease (12 months or more), you are exempt from proving short term rental use for up to three renewals.

100% Refund Eligibility

- Applications that are submitted in error.

- Customer submitted a different application than what they meant to (e.g., Special Event Permit vs. State Liquor License Endorsement).

- Customer applied for a record they don’t need for their business operations (e.g., Uber driver applying for a Vehicle for Hire Operating License).

- Customers trying to renew existing records, but they submit a new application by mistake.

In this instance, request a transfer of the fees paid to cover the existing renewal fee and that the remaining amount be refunded to the applicant.

75% Refund Eligibility

- Applications withdrawn before the application has been completed.

- Staff process the application for completion, deem it incomplete and send notice to the applicant. If instead of completing the application, the applicant withdraws their applicant, then they will be refunded 75% of the fees paid.

50% Refund Eligibility

- Applications are withdrawn before staff reviews are completed.

- Application has been deemed complete and staff reviews have begun. However, the applicant withdraws the application before staff reviews have been completed. They will be refunded 50% of the fees paid.

25% Refund Eligibility

- Applications are withdrawn after staff reviews have been completed. Staff reviews have been completed and some require revisions before they approve the application for record issuance. A notice of required revisions is sent to the applicant, but instead of submitted revisions, they withdraw their application. They will be refunded 25% of the fees paid.

0% Refund

- Applications are withdrawn after staff reviews have been completed and the record is ready for issuance or has already been issued. Staff reviews are completed in “approved” statuses and the record is ready to be issued or the record has already been issued. In this instance, there will be no refund of fees paid.

Transportation Fees

- If the STR license has been issued, the transportation fee is nonrefundable.

- If the STR license has not been issued, the transportation fee is 100% refundable.

Requests for the transportation fee refunds should be made separately from requests for licensing fee refunds.

Comprehensive information on the City of Bend’s Short Term Rental program can be found in the following code sections:

Hours:

Monday through Friday

Customer Resources

8 a.m. – 5 p.m.

Permit Inquiries

9 a.m. – 4 p.m.

Closed most major holidays.

Address:

710 NW Wall Street

Bend, OR 97703